Ally Unlimited Cash Back Mastercard®: Experience Limitless Rewards and Peace of Mind

Embark on a financial experience like no other with the Ally Unlimited Cash Back Mastercard®. As you navigate the world of credit cards, Ally presents an opportunity that goes beyond the ordinary – a card designed to make every purchase count, offering unlimited 2% cash back with no exceptions or expirations. Whether you’re a seasoned rewards enthusiast or exploring the benefits of cash back for the first time, the Ally Unlimited Cash Back Mastercard® brings simplicity, transparency, and unmatched value to your wallet. Join us as we delve into the features, benefits, and the seamless application process of this extraordinary credit card, designed with you in mind.

Unlimited 2% Cash Back, No Exceptions

Say goodbye to limitations and expirations. Enjoy a flat 2% cash back on all your purchases, all the time. Whether it’s your everyday essentials or special treats, your cash back keeps accumulating with no strings attached.

A Card That Starts with You

Crafted with a rewarding relationship in mind, the Ally Unlimited Cash Back Mastercard® is here to align with your financial goals.

An Opportunity for You

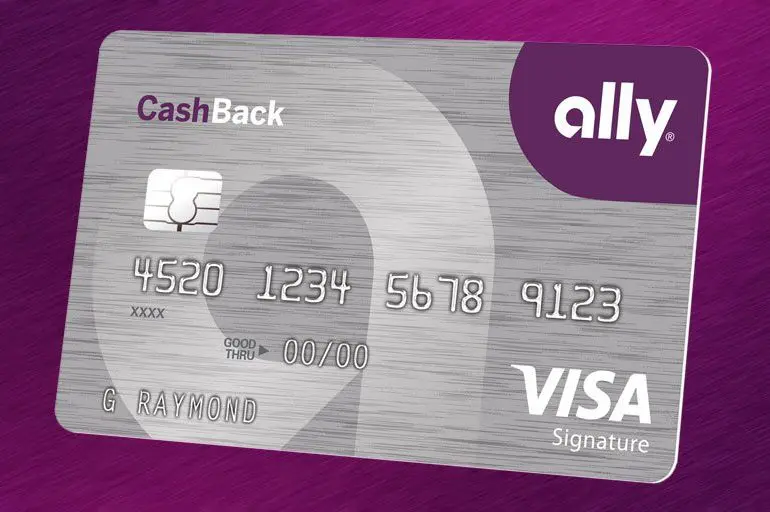

Ally Unlimited CashBack Credit Card Mastercard

Special Promotions and Offers

Check your personalized offer for exclusive promotions, rates, and fees. Your eligibility is subject to credit approva

Mistakes happen; we won't penalize you for them.

Late payments won't lead to increased rates, providing peace of mind

Assistance is just a call away, whenever you need it.

Enjoy the convenience of contactless payments.

Respond to a Mail Offer in Minutes

If you’ve received a mail offer, you’re just minutes away from unlocking the benefits of the Ally Unlimited Cash Back Mastercard®. For those without an offer, stay tuned—we’re excited to introduce a credit card you can believe in. Trust Ally to bring you financial solutions that align with your needs.