Unlock Financial Freedom Now: Apply for Your New Credit Card!

Ready to take control of your financial journey? Congratulations! You may already be pre-approved for your new credit card, which can open doors to countless opportunities. Here’s why you should take this chance:

Your credit score is your financial report card, and a good credit score opens doors to opportunities you never knew existed. By using your credit card responsibly – making timely payments, keeping your balance low – you’re not just making purchases; you’re investing in your future. From securing a mortgage to getting approved for a car loan, a strong credit score is the key to reaching your goals.

Advantages of our card recommender:

- ✅ Works based on your needs

- ✅ Purchase Protection

- ✅ %100 FREE

Embarking on the credit card journey may seem overwhelming, but fear not – we’re here to help, completely free of charge. Our dedicated team of financial experts is committed to helping you find the perfect credit card tailored to your unique needs and lifestyle. With our wealth of knowledge and industry insights, we will guide you towards the best options available on the market, ensuring you make informed decisions every step of the way.

To avoid paying interest on your credit card balance, you can pay the full statement balance by the due date each month. By doing so, you’ll enjoy an interest-free grace period on new purchases. Additionally, some cards offer promotional periods with 0% APR on purchases or balance transfers, allowing you to avoid interest for a specified period.

You can improve your credit score by using your credit card responsibly, such as making payments on time, keeping your credit utilization ratio low, and avoiding excessive debt. Additionally, maintaining a mix of credit accounts and limiting new credit applications can also positively impact your score over time.

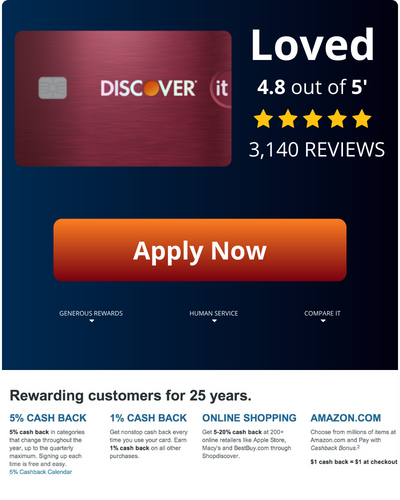

There are various types of credit cards, including rewards cards, cashback cards, travel cards, secured cards, and low-interest cards. Each type offers different benefits and features, so it’s essential to choose one that aligns with your spending habits and financial goals.

Yes, paying your credit card bill early can have several benefits. It can help reduce your credit utilization ratio, which can positively impact your credit score. Additionally, early payments can save you money on interest charges, especially if you carry a balance from month to month. Plus, it gives you peace of mind knowing your bill is taken care of ahead of schedule.

Don’t let this opportunity pass you by. Take the first step towards financial empowerment and apply for the credit card that is waiting for you today. Our team is here for you to provide full support.